指标特色 Indicator Features

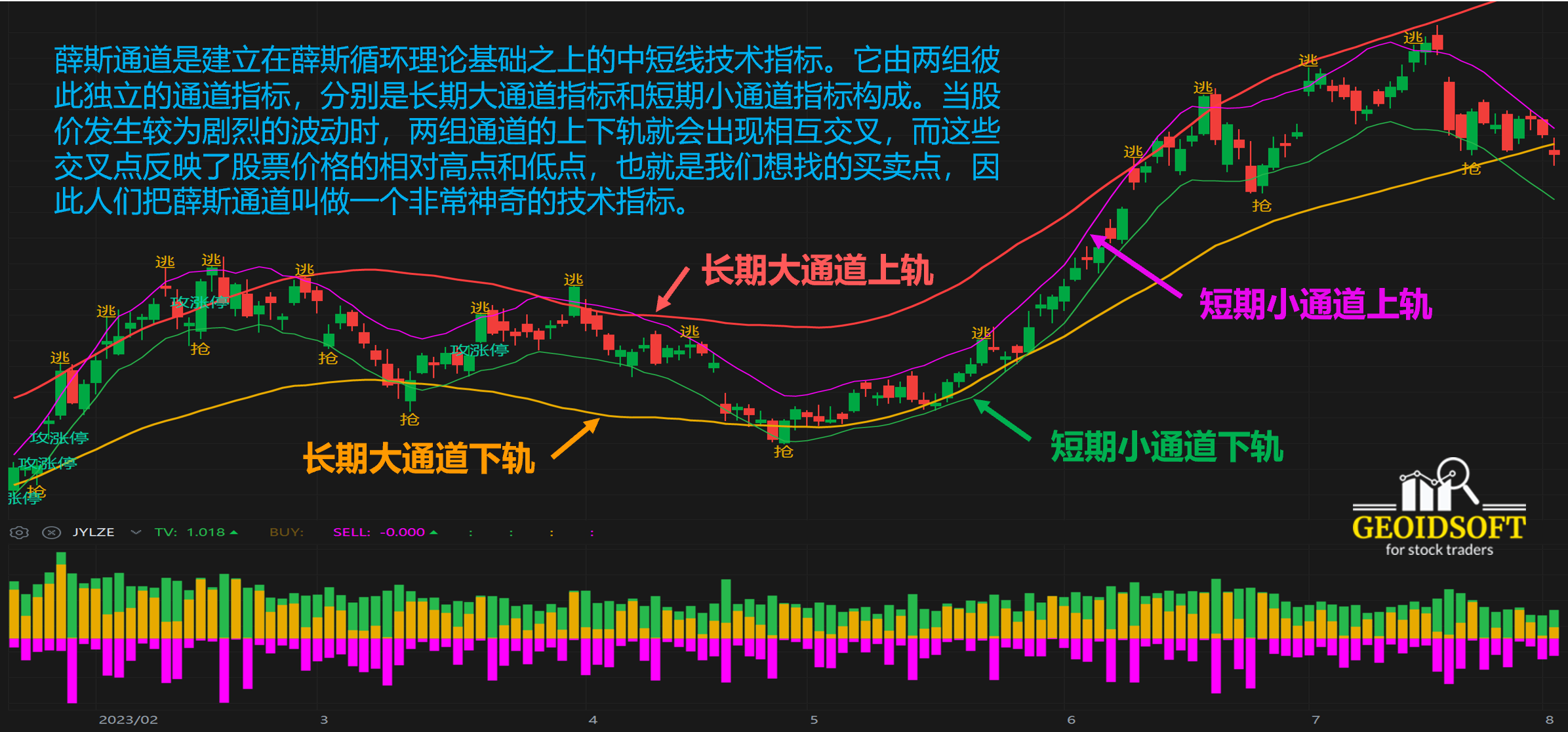

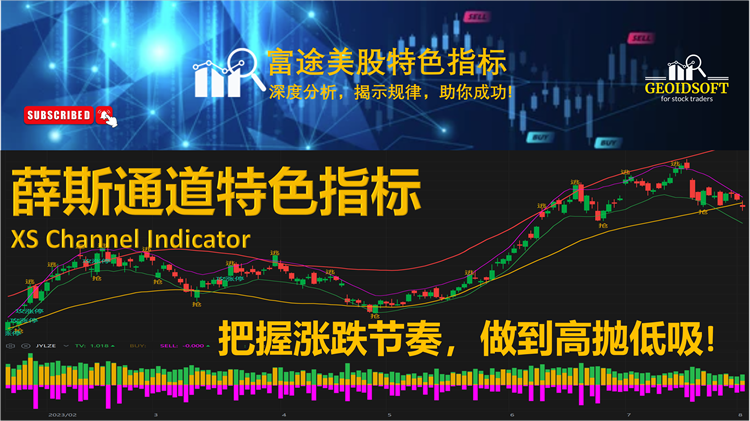

薛斯通道是建立在薛斯循环理论基础之上的中短线技术指标。它由两组彼此独立的通道指标,分别是长期大通道指标和短期小通道指标构成。当股价发生较为剧烈的波动时,两组通道的上下轨就会出现相互交叉,而这些交叉点反映了股票价格的相对高点和低点,也就是我们想找的买卖点,因此人们把薛斯通道叫做一个非常神奇的技术指标。

The XS channel is a short-term technical indicator based on the Xeres cycle theory. It consists of two independent channel indicators, which are long-term large channel indicator and short-term small channel indicator. When the stock price fluctuates more violently, the upper and lower rails of the two sets of channels will cross each other, and these cross points reflect the relative high and low points of the stock price, which is the buying and selling point we want to find. Hence, the XS channel is called a very magical technical indicator.

指标说明 Indicator Description

指标说明请观看我们的Youtube频道。For Indicator Description, please watch our YouTube channel.

https://youtu.be/EP3OlY_5krU

应用法则 Application Rules

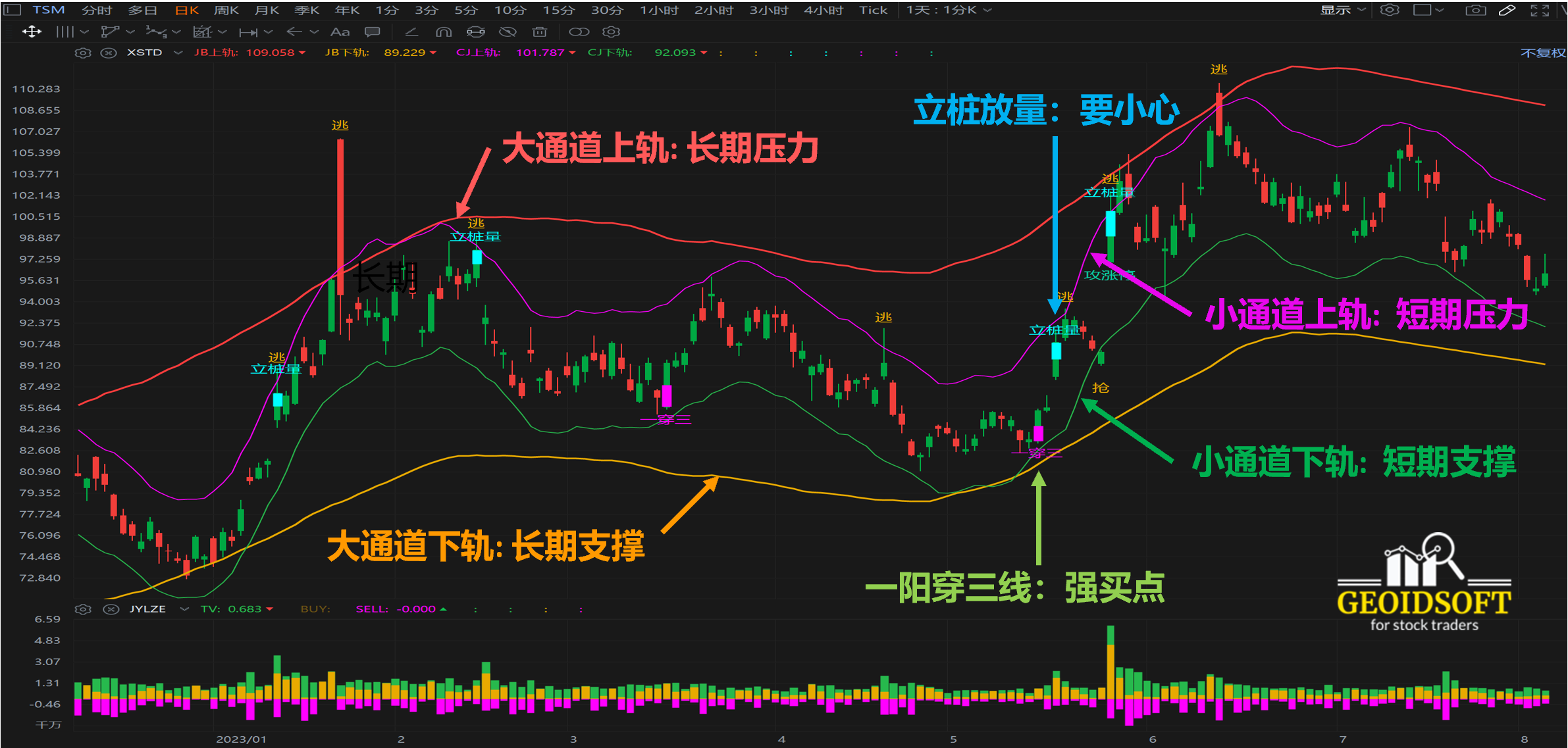

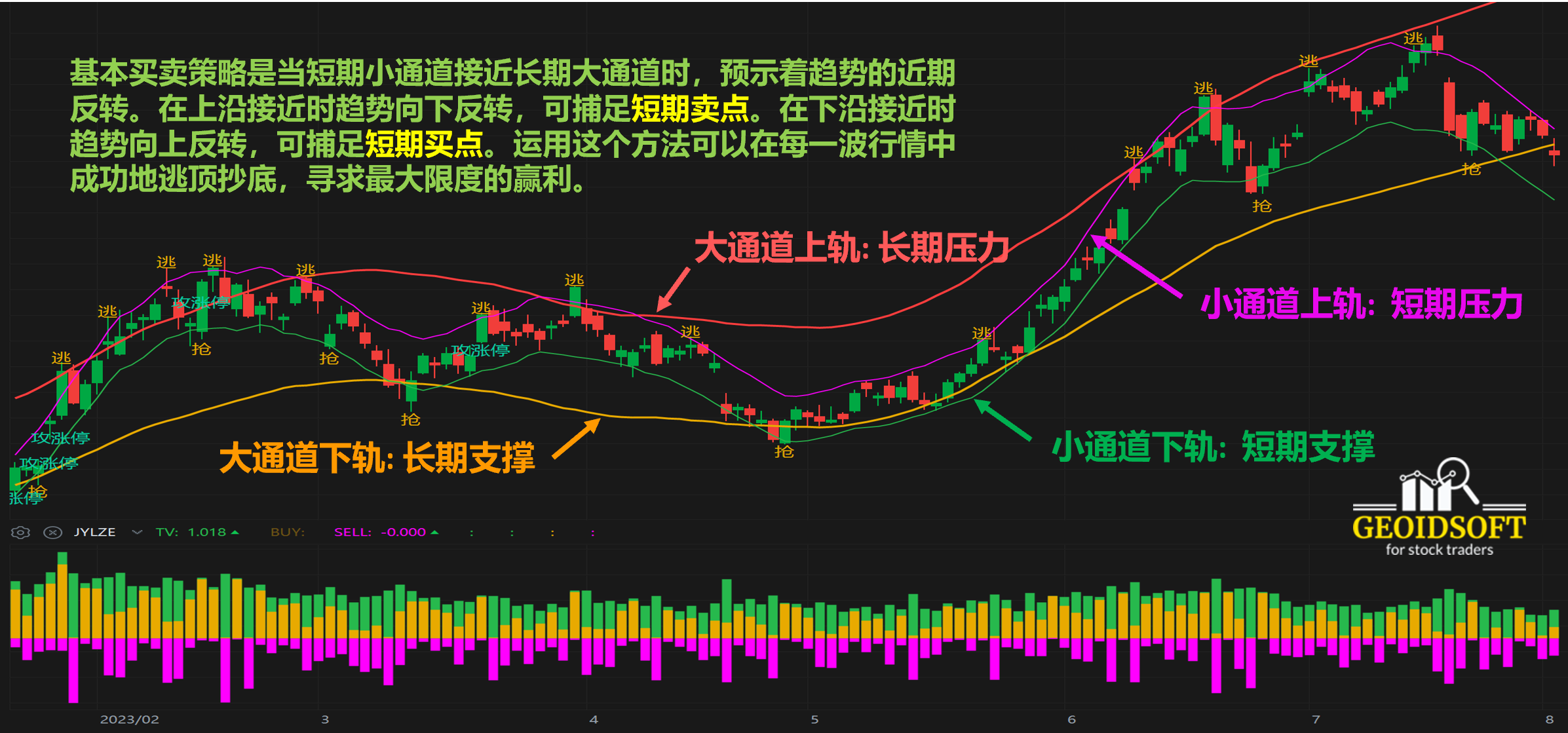

薛斯通道分为大通道(长时间周期,一般为100天)与小通道(短时间周期,一般为10天),在谷底当股价触及大通道下轨时买进,在峰顶当股价触及大通道上轨时卖出。但在实际操作中,小通道下轨触及大通道下轨也是买进时机,小通道上轨触及大通道上轨也是卖出时机。股价触及大通道下轨,此时股价往往正处在谷底位置;股价触及大通道上轨,此时股价往往处在峰顶位置,因而用薛斯通道操作,也可称为峰谷操作法。用薛斯通道抄底,往往能够找到最佳买点,而在逃顶方面则稍逊一筹,经常出现股价尚未触及大通道上轨便开始回落的情况。因此,逃顶时可结合其他的指标,或是采用固定收益卖出法:预先设定10%的收益率,一旦股价升至此位便坚决出局。

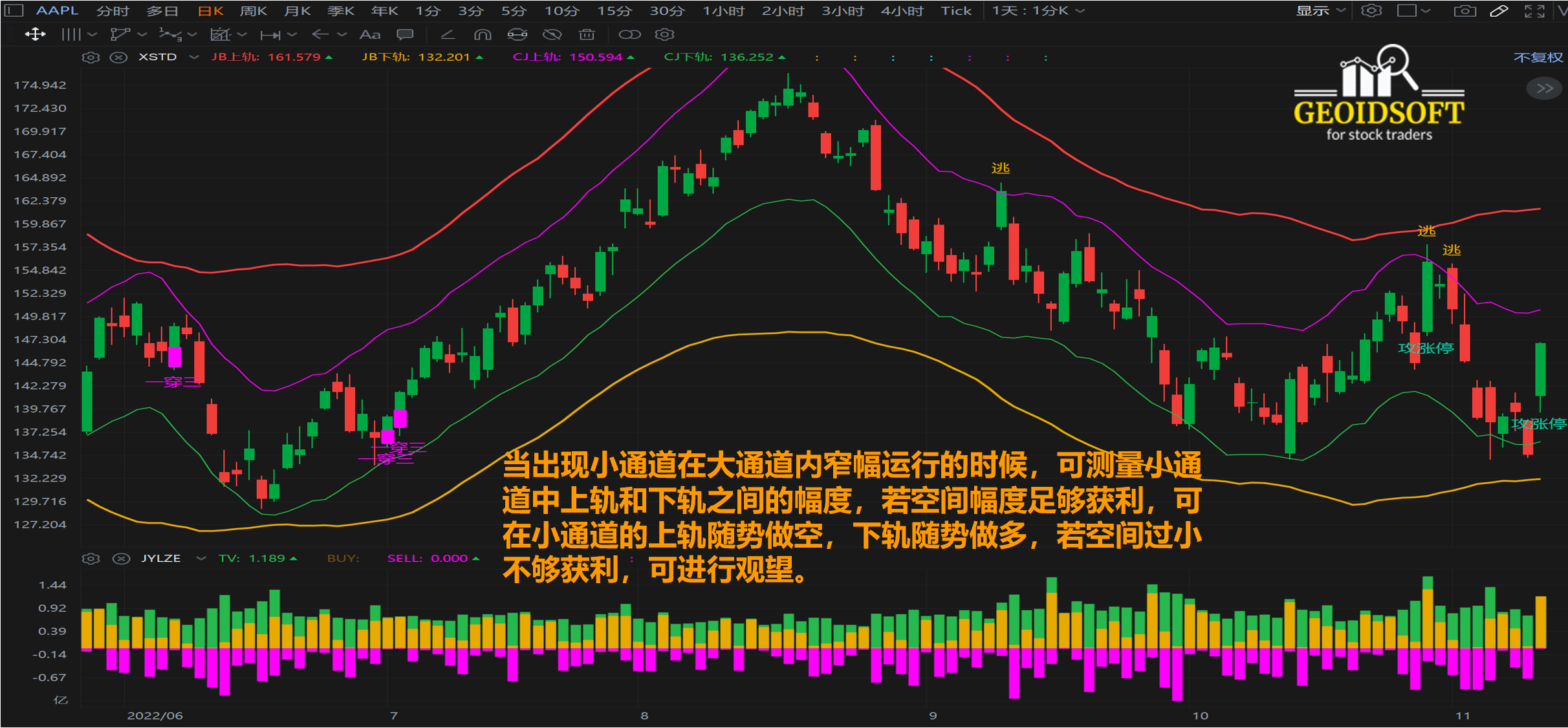

1,窄幅震荡:当出现大通道和小通道都保持水平趋势运行的时候,市场价格会在小通道中进行盘整,这种窄幅盘整状态,可测量小通道中上轨和下轨之间的幅度,若空间幅度足够获利,可在小通道的上轨做空,下轨做多,若空间过小不够获利,可进行观望。

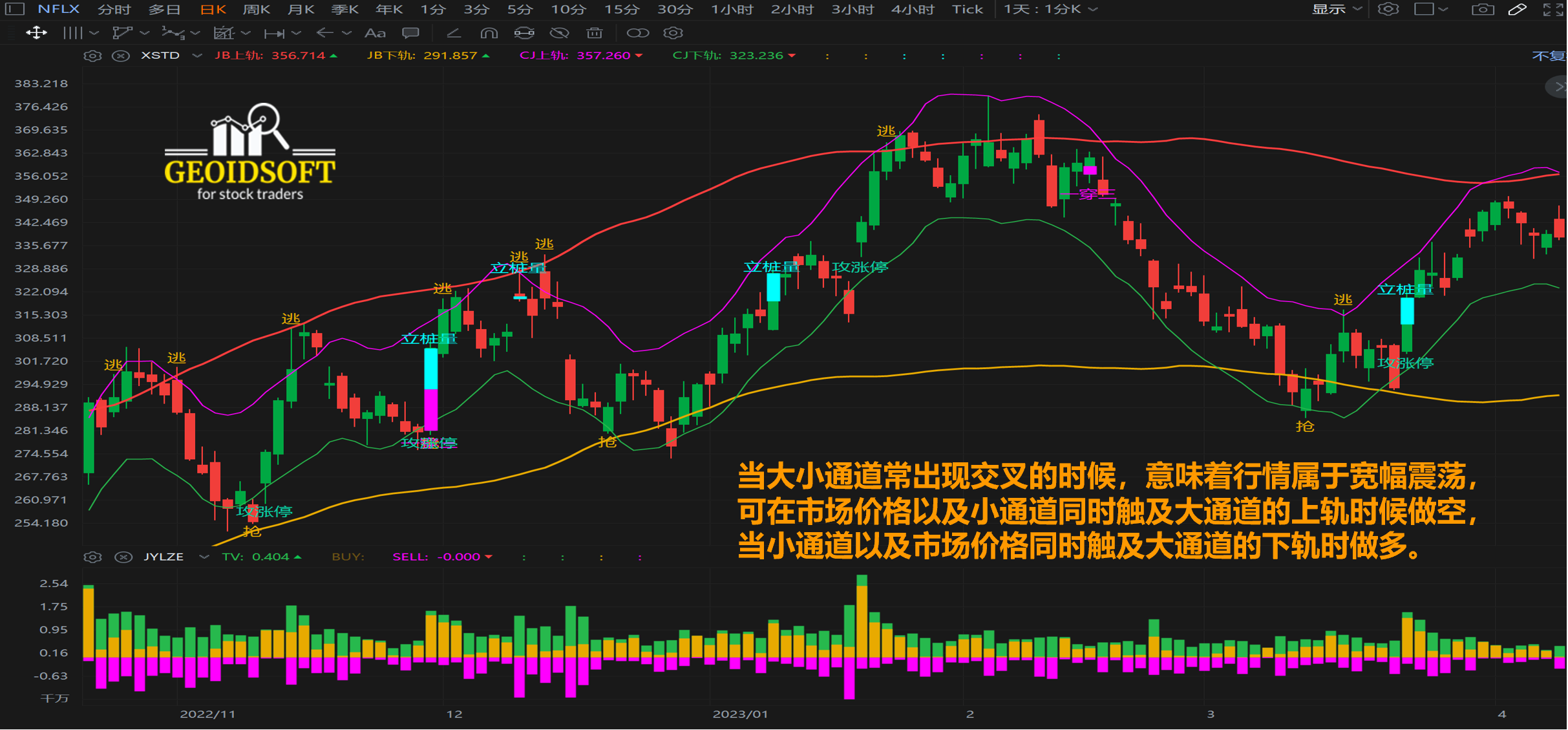

2,宽幅震荡:当薛斯通道的大通道保持水平状态,小通道走出小的单边行情的时候,意味着行情属于宽幅震荡,可在市场价格以及小通道同时触及大通道的上轨时候做空,当小通道以及市场价格同时触及大通道的下轨时做多。

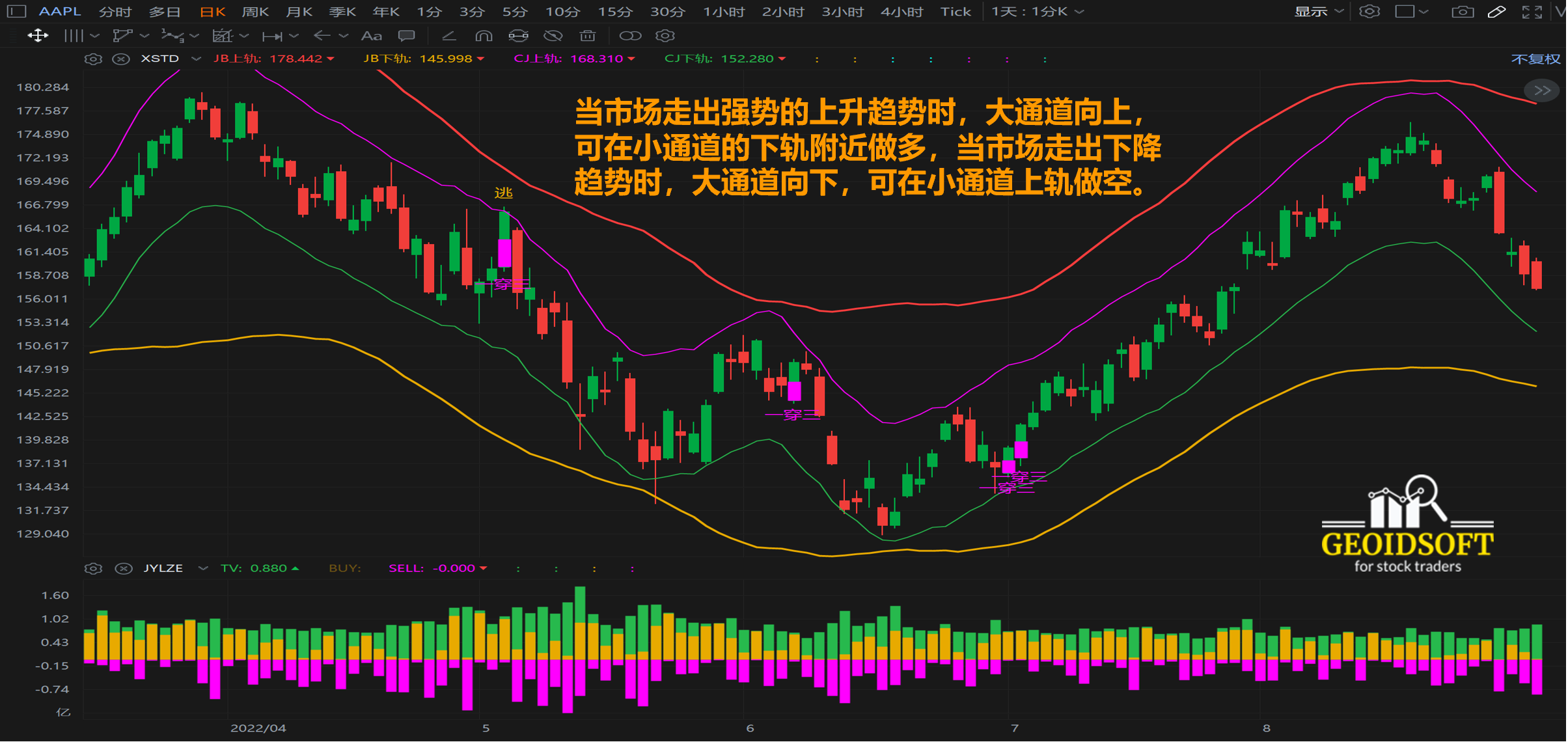

3,单边趋势:当市场走出强势的上升趋势时,大通道向上,小通道紧贴大通道的上轨震荡向上,可在小通道的下轨附近做多,当市场走出下降趋势时,大通道向下,小通道紧贴大通道下轨震荡向下,可在小通道上轨做空。

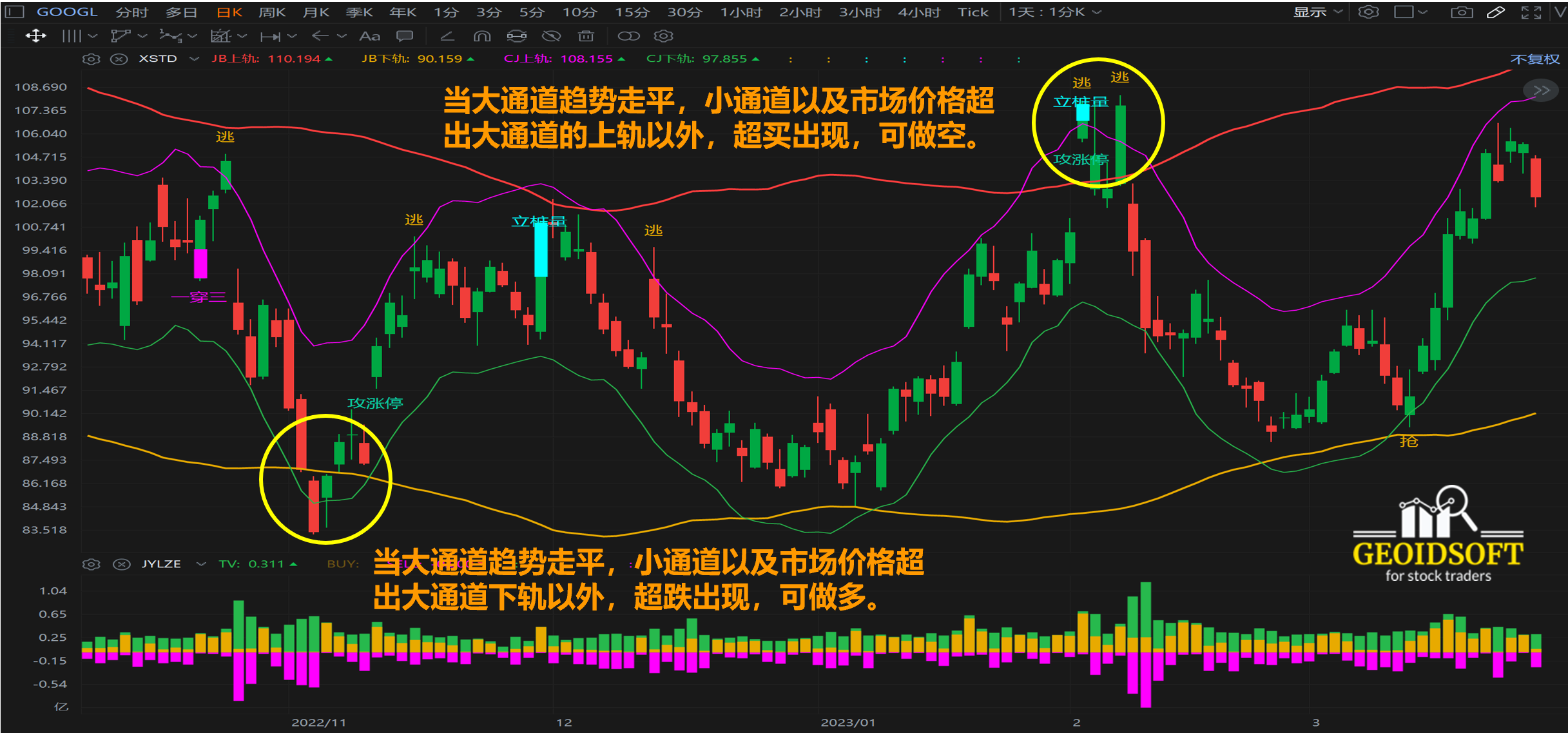

4,超买超卖:当大通道保持水平,小通道以及市场价格超出大通道的上轨以外,超买出现,可做空,当小通道以及市场价格超出大通道下轨以外,超跌出现,可做多。

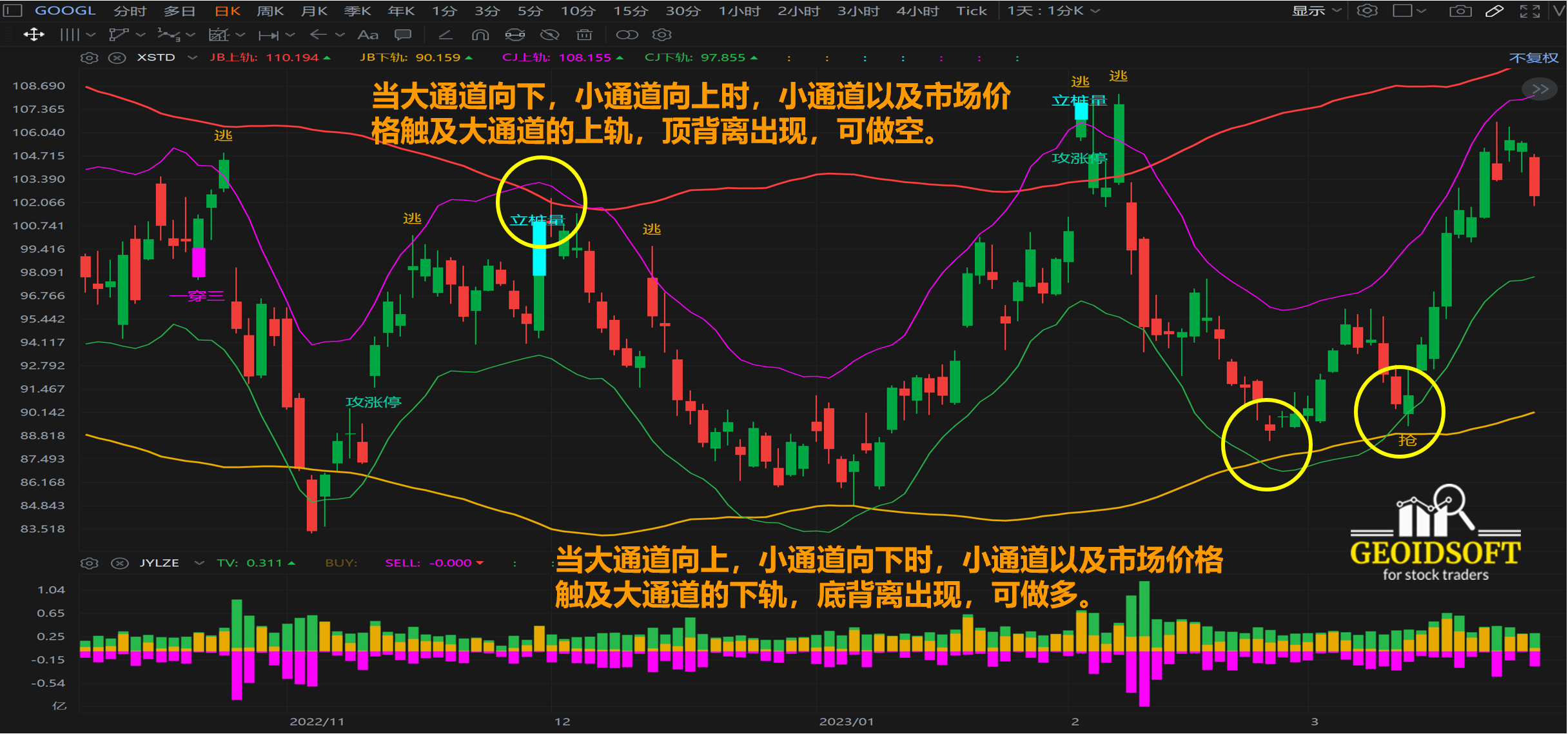

5,背离:当大通道向下,小通道向上时,小通道以及市场价格触及大通道的上轨,顶背离出现,可做空,当大通道向上,小通道向下时,小通道以及市场价格触及大通道的下轨,底背离出现,可做多。

应用范例 Application Example

应用范例请观看我们的Youtube频道。For application examples, please watch our YouTube channel.

https://youtu.be/EP3OlY_5krU

适用范围 Scope of Application

薛斯通道指标主要适合日K以上的时间周期。It is mainly suitable for the time period above daily K.

建议作为趋势变化和确定买卖点的观察指标, 结合其他指标进行综合分析观察,构建更有效的操盘系统, 帮助您进行操盘决策。

It is recommended to be used as an auxiliary indicator to understand the strength and weakness of the trend, combined with other indicators for comprehensive analysis and observation, to build a more effective trading system, and to help you make trading decisions.

注意事项 Precautions

指标的计算结果与预设的参数有关。可以根据不同的股票波动特性进行优化和调整, 以便达到最佳效果。

The calculation result of the indicator is related to the preset parameters. It can be optimized and adjusted according to different stock volatility characteristics in order to achieve the best effect.